CONTACT ELI SKLAR LOANS TODAY!

Contact Us

Fed Rate Cuts Could Be Coming: What It Means for Borrowers

The U.S. economy may be entering a new phase, as signs emerge that the Federal Reserve could ease its monetary policy soon. This potential shift comes in response to evolving labor market conditions, signaling that inflation is under control and the economy is stabilizing. Here’s what this means for the mortgage market and homebuyers.

Why Rate Cuts Are Expected

Recent reports indicate a cooling labor market, with job growth slowing and unemployment ticking slightly higher. Wage inflation has also moderated, easing concerns about the economy overheating. As inflation continues to decline — with the latest data showing it well within the Fed’s target range — economists believe the Fed may cut interest rates as early as Q4 2024.

Lower rates would be a welcome relief for borrowers, as the Fed's aggressive hikes over the past two years significantly pushed up borrowing costs for consumers, especially in the mortgage sector.

Impact on Mortgage Rates and Homebuyers

Although the Federal Reserve’s actions don't directly control mortgage rates, they heavily influence them. Mortgage rates, currently at their lowest in two years, could drop further if the Fed reduces its benchmark rate. This would increase affordability and attract buyers who have been waiting on the sidelines for better borrowing conditions.

However, with more favorable rates, demand could quickly rise, leading to increased competition and upward pressure on home prices. Prospective buyers should consider acting promptly before market activity accelerates.

What This Means for the Housing Market

The housing market is already showing signs of recovery, with active inventory up by over 30% year-over-year and homes spending longer on the market. If mortgage rates decline further, sellers may see renewed interest, potentially reversing the recent trend of price cuts. Buyers will have to stay vigilant, as a more competitive landscape could quickly emerge.

Key Takeaways

Rate Cuts Likely Soon: Fed may begin lowering rates by the end of 2024 due to easing inflation and slower job growth.

Lower Mortgage Rates Possible: Borrowers could see better loan terms, enhancing affordability.

Increased Competition Expected: As rates fall, homebuyers may face a tighter market with rising prices.

Now is a crucial time to assess your financial readiness and lock in favorable terms before the market adjusts to new economic realities. Consulting with a mortgage advisor can help navigate these shifting dynamics effectively.

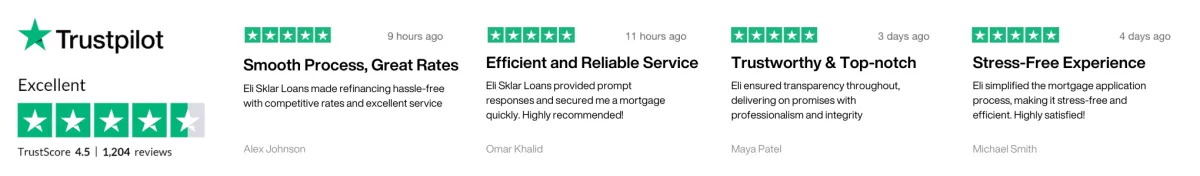

SUCCESS STORIES FROM OUR CLIENTS

I can't thank Eli enough for his assistance in securing a loan for my commercial property. His expertise and attention to detail were remarkable. Eli not only helped me find the right lender but also negotiated favorable terms that fit my financial goals. He made the entire process seamless and stress-free, and I felt confident knowing I had an expert advocating for my best interests. He is a true professional, and I highly recommend his services to anyone seeking a commercial loan.

Mike Erman

Real Estate Agent

Eli is an exceptional loan expert who helped me secure a commercial loan for my business expansion. His deep knowledge of the lending industry and his strong relationships with lenders made the process smooth and efficient. Eli took the time to understand my specific needs and goals, and he went above and beyond to ensure I received the best terms and rates. Thanks to Eli's expertise and dedication, I was able to take my business to the next level. I highly recommend Eli!

Jake Flynn

Real Estate Agent

Working with Eli was a game-changer for me as a real estate investor. His expertise and his ability to identify the right financing options truly impressed me. Eli took the time to understand my investment strategy and found tailored loan solutions that aligned perfectly with my goals. His professionalism, responsiveness, and attention to detail made the entire process stress-free. I am grateful to have had Eli as my trusted partner, and I highly recommend him to anyone!

Jan Brooks

Real Estate Agent

Copyright©Eli Sklar Loans 2024. All Rights Reserved.

eli@elisklarloans.com

+1 (516) 902‑8593