CONTACT ELI SKLAR LOANS TODAY!

Contact Us

5 Strategies for First-Time Homebuyers to Secure the Best Mortgage Rates

Purchasing your first home is an exciting milestone, but navigating the mortgage process can feel overwhelming. With fluctuating interest rates and varying loan options, it’s essential to have a solid strategy to secure the best terms. Here are five key strategies every first-time homebuyer should consider to maximize savings and minimize stress.

1. Strengthen Your Credit Score Before Applying

Your credit score plays a significant role in determining your mortgage rate. A higher score signals to lenders that you’re a low-risk borrower, qualifying you for better interest rates.

Tips to Improve Your Score: Pay bills on time, reduce existing debt, and avoid opening new credit accounts close to your mortgage application.

Check Your Credit Report: Request a free copy from major credit bureaus and correct any errors that could affect your score.

Even small improvements to your credit score before applying can save you thousands over the life of your loan.

2. Compare Loan Offers from Multiple Lenders

It pays to shop around. Different lenders may offer varying rates, loan terms, and fees, even if your financial profile remains the same.

Use Online Comparison Tools: These platforms can help you quickly see the best offers from various lenders.

Look Beyond Big Banks: Explore options like credit unions, regional banks, and mortgage brokers, as they might offer competitive terms.

3. Get Pre-Approved to Know Your Budget

Pre-approval not only gives you a clear picture of what you can afford but also makes you more attractive to sellers.

Difference Between Pre-Qualification and Pre-Approval: Pre-approval involves a more thorough check and carries more weight during negotiations.

Lock in Rates Early: Some lenders allow rate locks during pre-approval, which can protect you from market changes before you close.

4. Understand Fixed vs. Adjustable Rates

Choosing between a fixed-rate and an adjustable-rate mortgage (ARM) depends on your financial goals.

Fixed-Rate Loans: Offer consistent payments over the life of the loan, ideal for buyers planning to stay in the home long-term.

Adjustable-Rate Mortgages (ARMs): Start with lower initial rates that adjust periodically, which can be beneficial if you expect to sell or refinance in a few years.

5. Time Your Purchase with Market Trends

Mortgage rates fluctuate with market conditions, so paying attention to trends can help you lock in a better deal.

Monitor Economic Indicators: Fed rate changes, inflation, and employment reports can influence mortgage rates.

Be Ready to Act: If rates drop, act quickly to lock in before they rise again.

By following these strategies, first-time homebuyers can approach the mortgage process confidently and secure a loan that fits their financial goals. A trusted mortgage advisor can guide you through these steps, ensuring you make informed decisions throughout the process.

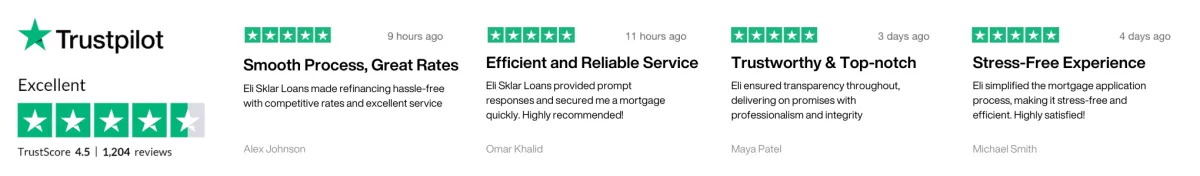

SUCCESS STORIES FROM OUR CLIENTS

I can't thank Eli enough for his assistance in securing a loan for my commercial property. His expertise and attention to detail were remarkable. Eli not only helped me find the right lender but also negotiated favorable terms that fit my financial goals. He made the entire process seamless and stress-free, and I felt confident knowing I had an expert advocating for my best interests. He is a true professional, and I highly recommend his services to anyone seeking a commercial loan.

Mike Erman

Real Estate Agent

Eli is an exceptional loan expert who helped me secure a commercial loan for my business expansion. His deep knowledge of the lending industry and his strong relationships with lenders made the process smooth and efficient. Eli took the time to understand my specific needs and goals, and he went above and beyond to ensure I received the best terms and rates. Thanks to Eli's expertise and dedication, I was able to take my business to the next level. I highly recommend Eli!

Jake Flynn

Real Estate Agent

Working with Eli was a game-changer for me as a real estate investor. His expertise and his ability to identify the right financing options truly impressed me. Eli took the time to understand my investment strategy and found tailored loan solutions that aligned perfectly with my goals. His professionalism, responsiveness, and attention to detail made the entire process stress-free. I am grateful to have had Eli as my trusted partner, and I highly recommend him to anyone!

Jan Brooks

Real Estate Agent

Copyright©Eli Sklar Loans 2024. All Rights Reserved.

eli@elisklarloans.com

+1 (516) 902‑8593