READY TO EXPAND YOUR REAL ESTATE INVESTMENTS WITH MORTGAGE?

READY TO EXPAND YOUR REAL ESTATE INVESTMENTS WITH MORTGAGE?

WHY WORK WITH US?

For over 12 years, Eli Sklar Loans has been the trusted mortgage advisor for individuals seeking to expand their real estate investments.

With expertise in closing construction loans, lines of credit, non-conventional loans, government loans, and jumbo lending, Eli Sklar Loans provides comprehensive support to clients navigating the complex world of mortgage financing.

Whether you're a seasoned investor or a newcomer to real estate, trust Eli Sklar Loans to guide you towards your financial goals with confidence and reliability.

Strong track record of successful loan closures

Proactive and responsive communication

Dedicated to finding tailored mortgage solutions

Trustworthy and reliable mortgage advisor

WHY WORK WITH US?

For over 12 years, Eli Sklar Loans has been the trusted mortgage advisor for individuals seeking to expand their real estate investments.

With expertise in closing construction loans, lines of credit, non-conventional loans, government loans, and jumbo lending, Eli Sklar Loans provides comprehensive support to clients navigating the complex world of mortgage financing.

Whether you're a seasoned investor or a newcomer to real estate, trust Eli Sklar Loans to guide you towards your financial goals with confidence and reliability.

Strong track record of successful loan closures

Proactive and responsive communication

Dedicated to finding tailored mortgage solutions

Trustworthy and reliable mortgage advisor

12+

YEARS OF EXPERIENCE IN MORTGAGE

1,500+

PROPERTIES FINANCED

NEARLY $1B

IN FINANCED PROPERTIES

97%

APPROVAL RATING

12+

YEARS OF EXPERIENCE IN MORTGAGE

1500+

PROPERTIES FINANCED

NEARLY $1B

IN FINANCED PROPERTIES

97%

APPROVAL RATING

HOW CAN WE HELP YOU?

COMPREHENSIVE MORTGAGE

Our comprehensive mortgage solutions cater to diverse needs, ensuring tailored financing options for every homeowner's unique circumstances.

MORTGAGE

REFINANCE

Streamline your finances with our mortgage refinance services, offering competitive rates and expert guidance to optimize your loan terms.

JUMBO AND

CONVENTIONAL LOANS

Secure substantial funding with our jumbo and high-value loan options, designed to meet the demands of luxury property acquisitions.

CONSTRUCTION LOANS

From groundbreaking to completion, our construction loans provide flexible financing solutions for building your dream home or investment property.

LINES OF CREDIT

Access flexible funds with our lines of credit, empowering homeowners to manage expenses and leverage their home equity strategically.

GOVERNMENT LOANS

Navigate the complexities of government-backed loans with ease, as we guide you through FHA, VA, and USDA loan programs.

Calculate Your Mortgage Payment

Calculate Your Mortgage Payment

Mortgage Market Update: October 2024

Mortgage Market Update: October 2024

The mortgage landscape in October 2024 presents both opportunities and challenges for potential homebuyers. Here's a snapshot of the key trends impacting the market this month.

Mortgage Rates on the Decline

Mortgage rates have eased recently, with average 30-year fixed-rate mortgages hovering between 5.95% and 6.25%, down from earlier highs in 2023. This shift reflects stabilizing inflation and potential future rate cuts from the Federal Reserve. Lower rates improve affordability, providing buyers with increased purchasing power, though the benefits depend on how quickly buyers act before rates adjust again.

Evolving Housing Market Conditions

The cooling of the housing market is evident with a 0.7% year-over-year drop in median listing prices and a 31.9% increase in active listings. Homes are now taking longer to sell, spending an average of seven more days on the market compared to last year. This increased inventory gives buyers more options, but the pace of sales has slowed as many remain cautious, waiting for more favorable conditions.

Challenges and Buyer Sentiment

Despite falling mortgage rates, affordability remains a concern due to historically low housing inventory and persistent high home prices. Demand for new homes has not surged yet, as some buyers are still waiting for deeper rate cuts or more attractive listings. However, those looking to purchase now could benefit from reduced competition in the market before any further rate changes spark increased demand.

What to Expect Going Forward

Experts predict that mortgage rates could continue to decline in late 2024 and 2025, making homeownership more attainable. However, this may also trigger higher demand, keeping home prices elevated despite economic improvements. Prospective buyers should stay informed and assess their financial readiness, as conditions may shift quickly with further Federal Reserve decisions or changes in housing supply.

This period presents a good opportunity for those ready to enter the market, especially with interest rates reaching their lowest point in two years. As always, working with an experienced mortgage advisor can help buyers navigate the complexities of these shifting market dynamics.

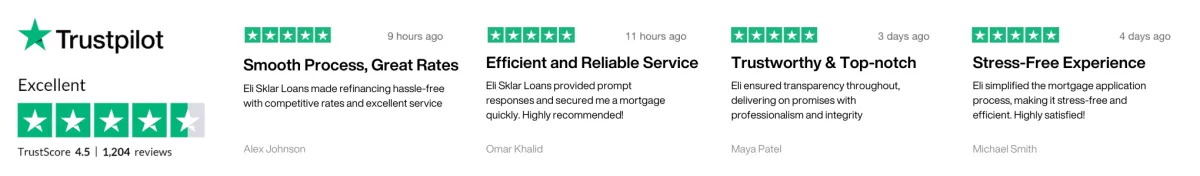

SUCCESS STORIES FROM OUR CLIENTS

I can't thank Eli enough for his assistance in securing a loan for my commercial property. His expertise and attention to detail were remarkable. Eli not only helped me find the right lender but also negotiated favorable terms that fit my financial goals. He made the entire process seamless and stress-free, and I felt confident knowing I had an expert advocating for my best interests. He is a true professional, and I highly recommend his services to anyone seeking a commercial loan.

Mike Erman

Real Estate Agent

Eli is an exceptional loan expert who helped me secure a commercial loan for my business expansion. His deep knowledge of the lending industry and his strong relationships with lenders made the process smooth and efficient. Eli took the time to understand my specific needs and goals, and he went above and beyond to ensure I received the best terms and rates. Thanks to Eli's expertise and dedication, I was able to take my business to the next level. I highly recommend Eli!

Jake Flynn

Real Estate Agent

Working with Eli was a game-changer for me as a real estate investor. His expertise and his ability to identify the right financing options truly impressed me. Eli took the time to understand my investment strategy and found tailored loan solutions that aligned perfectly with my goals. His professionalism, responsiveness, and attention to detail made the entire process stress-free. I am grateful to have had Eli as my trusted partner, and I highly recommend him to anyone!

Jan Brooks

Real Estate Agent

Copyright©Eli Sklar Loans 2024. All Rights Reserved.

eli@elisklarloans.com

+1 (516) 902‑8593

Copyright©Eli Sklar Loans 2024. All Rights Reserved.

eli@elisklarloans.com

+1 (516) 902‑8593