READY TO EXPAND YOUR REAL ESTATE INVESTMENTS WITH MORTGAGE?

READY TO EXPAND YOUR REAL ESTATE INVESTMENTS WITH MORTGAGE?

WHY WORK WITH US?

For over 12 years, Eli Sklar Loans has been the trusted mortgage advisor for individuals seeking to expand their real estate investments.

With expertise in closing construction loans, lines of credit, non-conventional loans, government loans, and jumbo lending, Eli Sklar Loans provides comprehensive support to clients navigating the complex world of mortgage financing.

Whether you're a seasoned investor or a newcomer to real estate, trust Eli Sklar Loans to guide you towards your financial goals with confidence and reliability.

Strong track record of successful loan closures

Proactive and responsive communication

Dedicated to finding tailored mortgage solutions

Trustworthy and reliable mortgage advisor

WHY WORK WITH US?

For over 12 years, Eli Sklar Loans has been the trusted mortgage advisor for individuals seeking to expand their real estate investments.

With expertise in closing construction loans, lines of credit, non-conventional loans, government loans, and jumbo lending, Eli Sklar Loans provides comprehensive support to clients navigating the complex world of mortgage financing.

Whether you're a seasoned investor or a newcomer to real estate, trust Eli Sklar Loans to guide you towards your financial goals with confidence and reliability.

Strong track record of successful loan closures

Proactive and responsive communication

Dedicated to finding tailored mortgage solutions

Trustworthy and reliable mortgage advisor

12+

YEARS OF EXPERIENCE IN MORTGAGE

1,500+

PROPERTIES FINANCED

NEARLY $1B

IN FINANCED PROPERTIES

97%

APPROVAL RATING

12+

YEARS OF EXPERIENCE IN MORTGAGE

1500+

PROPERTIES FINANCED

NEARLY $1B

IN FINANCED PROPERTIES

97%

APPROVAL RATING

HOW CAN WE HELP YOU?

COMPREHENSIVE MORTGAGE

Our comprehensive mortgage solutions cater to diverse needs, ensuring tailored financing options for every homeowner's unique circumstances.

MORTGAGE

REFINANCE

Streamline your finances with our mortgage refinance services, offering competitive rates and expert guidance to optimize your loan terms.

JUMBO AND

CONVENTIONAL LOANS

Secure substantial funding with our jumbo and high-value loan options, designed to meet the demands of luxury property acquisitions.

CONSTRUCTION LOANS

From groundbreaking to completion, our construction loans provide flexible financing solutions for building your dream home or investment property.

LINES OF CREDIT

Access flexible funds with our lines of credit, empowering homeowners to manage expenses and leverage their home equity strategically.

GOVERNMENT LOANS

Navigate the complexities of government-backed loans with ease, as we guide you through FHA, VA, and USDA loan programs.

Calculate Your Mortgage Payment

Calculate Your Mortgage Payment

How to Use Home Equity: Unlocking the Value of Your Property

Home equity is one of the most powerful financial tools available to homeowners. As property values rise, many homeowners find themselves sitting on significant equity, which can be strategically leveraged to achieve financial goals. This blog explores how to unlock and use your home’s equity effectively while avoiding common pitfalls.

What is Home Equity?

Home equity is the difference between your home’s market value and the balance of your mortgage. For example, if your property is worth $500,000 and you owe $300,000, you have $200,000 in equity.

There are two main ways to access home equity:

Home Equity Loan: A lump-sum loan with fixed payments, ideal for large, one-time expenses.

Home Equity Line of Credit (HELOC): A revolving credit line that works like a credit card, providing flexibility for ongoing or unexpected expenses.

Smart Ways to Use Home Equity

1. Home Improvement and Renovations

Using equity to fund renovations can increase your property’s value and improve your living experience.

Examples: Kitchen remodels, adding a deck, or upgrading HVAC systems.

ROI Consideration: Not all improvements add equal value. Focus on projects with high return on investment.

2. Debt Consolidation

If you’re carrying high-interest debt, like credit cards, a home equity loan with a lower interest rate can help you consolidate and pay off debt faster.

Benefit: Lower monthly payments and interest rates.

Risk: Your home becomes collateral, so it’s crucial to manage payments responsibly.

3. Investing in Property or Other Assets

Many homeowners use equity to purchase rental properties or invest in stocks, diversifying their financial portfolios.

Benefit: Real estate investments can generate passive income.

Risk: Investments carry risks, so consider consulting with a financial advisor before using home equity.

4. Emergency Funds and Life Expenses

A HELOC offers flexibility for managing unexpected expenses like medical emergencies or major repairs.

Benefit: Only pay interest on the amount you use.

Consideration: Avoid overusing a HELOC, as it could lead to debt accumulation.

5. Education and Retirement Planning

Home equity can also be used to fund education or supplement retirement income, providing financial freedom during significant life transitions.

Example: Some homeowners use a reverse mortgage during retirement to access equity without monthly payments.

Pros and Cons of Using Home Equity

Pros:

Lower interest rates compared to personal loans or credit cards.

Potential tax benefits if the funds are used for home improvements.

Cons:

Risk of foreclosure if payments are missed.

Reduces the amount of equity available if you decide to sell your home.

Conclusion

Unlocking home equity can be a smart financial move, but it requires careful planning. Whether you’re renovating, consolidating debt, or investing, it's essential to assess your financial goals and risk tolerance. Consulting with a mortgage advisor can help you make the best use of your home’s value without jeopardizing your financial stability.

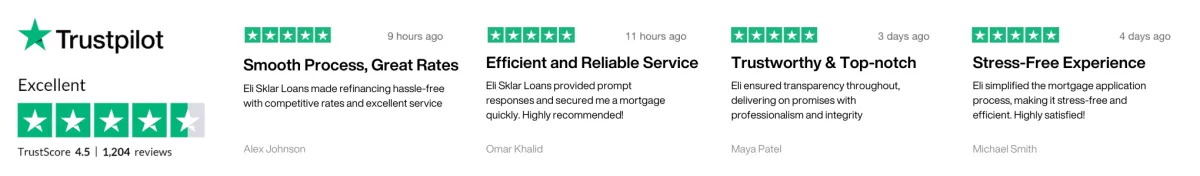

SUCCESS STORIES FROM OUR CLIENTS

I can't thank Eli enough for his assistance in securing a loan for my commercial property. His expertise and attention to detail were remarkable. Eli not only helped me find the right lender but also negotiated favorable terms that fit my financial goals. He made the entire process seamless and stress-free, and I felt confident knowing I had an expert advocating for my best interests. He is a true professional, and I highly recommend his services to anyone seeking a commercial loan.

Mike Erman

Real Estate Agent

Eli is an exceptional loan expert who helped me secure a commercial loan for my business expansion. His deep knowledge of the lending industry and his strong relationships with lenders made the process smooth and efficient. Eli took the time to understand my specific needs and goals, and he went above and beyond to ensure I received the best terms and rates. Thanks to Eli's expertise and dedication, I was able to take my business to the next level. I highly recommend Eli!

Jake Flynn

Real Estate Agent

Working with Eli was a game-changer for me as a real estate investor. His expertise and his ability to identify the right financing options truly impressed me. Eli took the time to understand my investment strategy and found tailored loan solutions that aligned perfectly with my goals. His professionalism, responsiveness, and attention to detail made the entire process stress-free. I am grateful to have had Eli as my trusted partner, and I highly recommend him to anyone!

Jan Brooks

Real Estate Agent

Copyright©Eli Sklar Loans 2024. All Rights Reserved.

eli@elisklarloans.com

+1 (516) 902‑8593

Copyright©Eli Sklar Loans 2024. All Rights Reserved.

eli@elisklarloans.com

+1 (516) 902‑8593